How bunq provides

data-driven insights?

bunq - the Dutch challenger bank was struggling to achieve a high coverage of merchant reconciliation. Learn more about how TapiX helped them through payment data enrichment.

TapiX is the industry-leading API service providing banks and fintechs with transaction data enrichment.

Trusted by 50+ global banks and fintechs

Collect raw merchant descriptions from card transaction, bank transfers or open banking (PSD2) payments.

TapiX engine enriches raw transaction data into actionable insights and send them back to your infrastructure.

Get clean, structured data that's ready to use for your analytical, UX, sustainability or business cases.

We believe that the better data you have, the less work you have to do. Richer data streamlines your work, transforming chaos into clarity. Put full focus on solution building, rather than messy data wrangling.

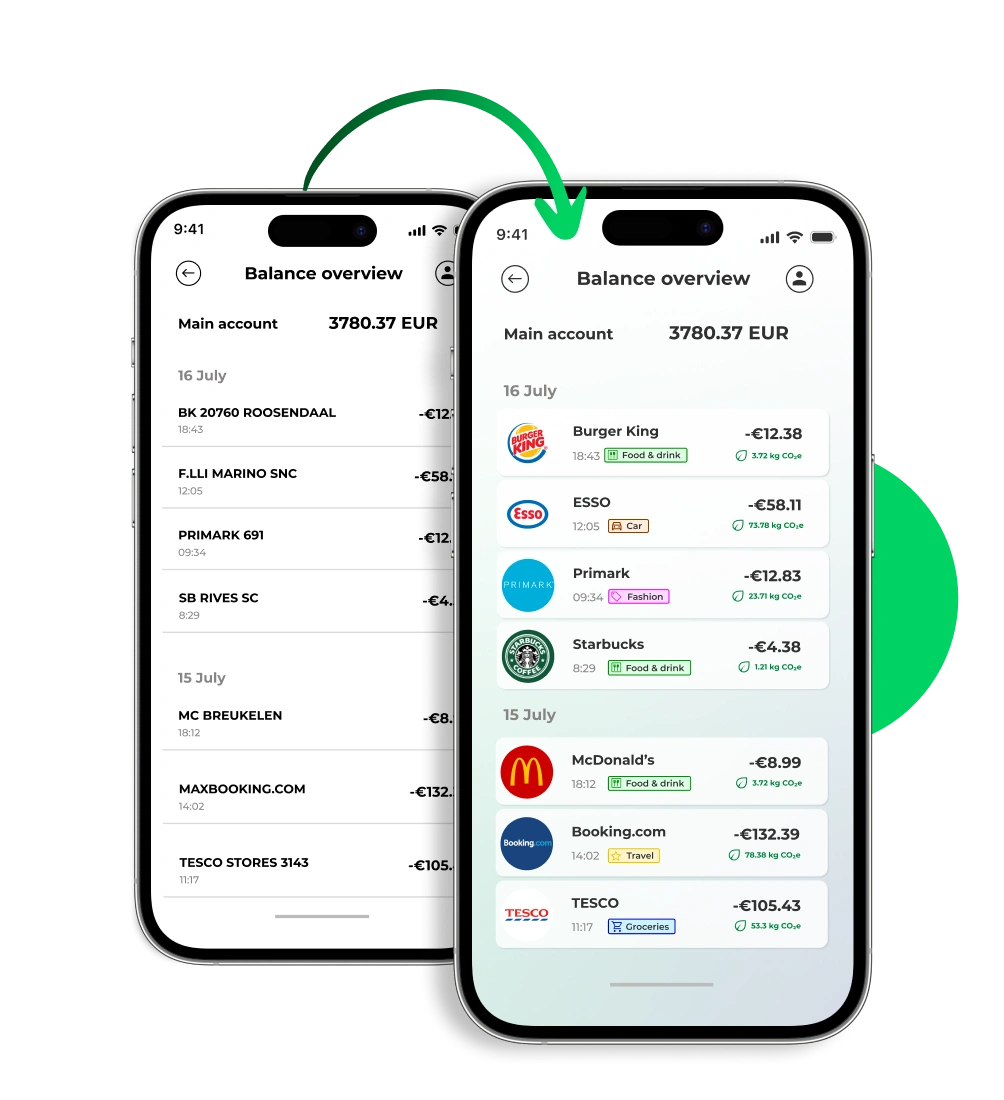

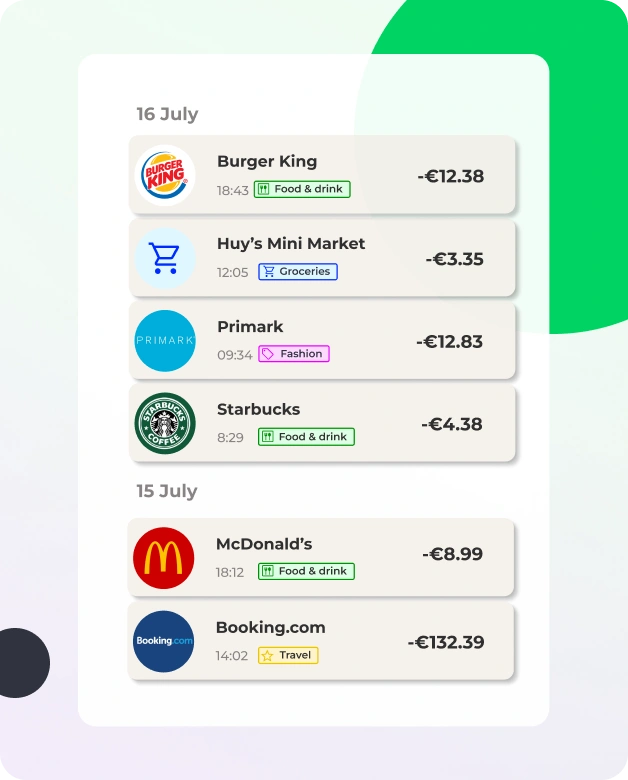

Clean and accurate merchant name with identification down to franchise and sub-brand levels.

URL of the merchant's website respecting the language preferences of clients.

Identifier for Google Place ID through which you can get shop level info about opening hours, ratings or contact phone number.

Manually proofed and high quality country specific merchant logo for quick visual recognition.

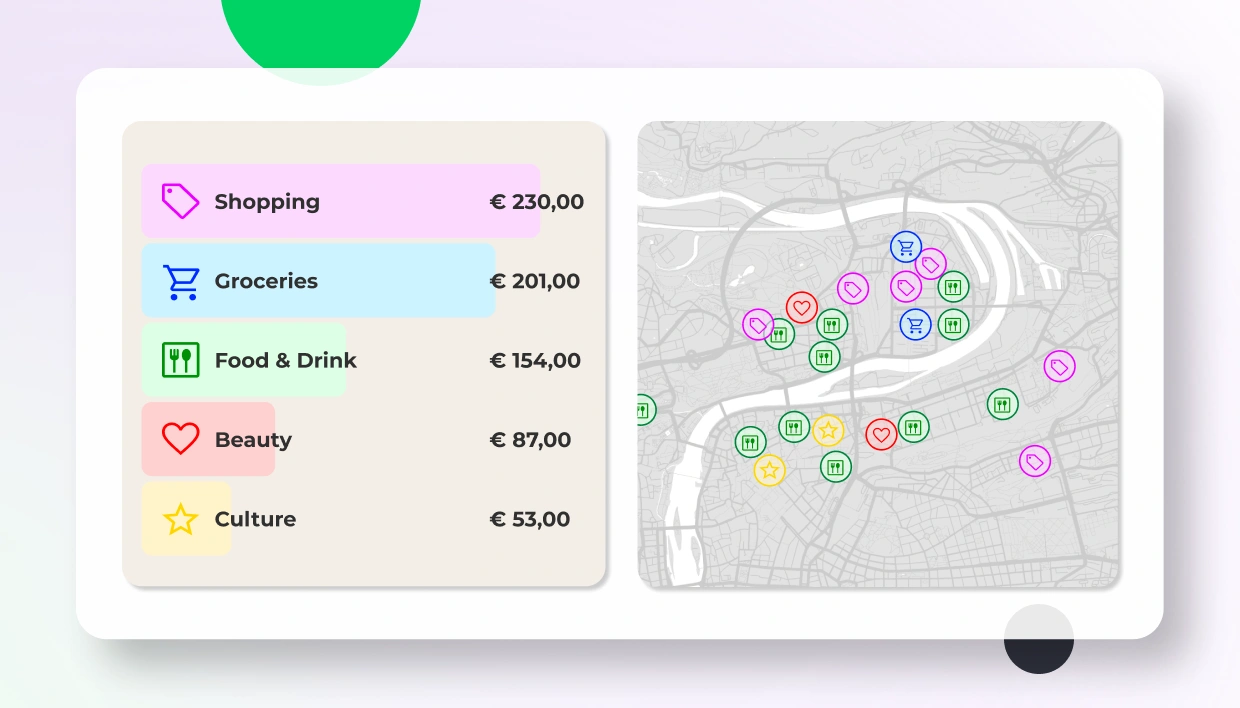

25 categories at merchant level & 500+ tags at shop level for the most efficient segmentation and identification surpassing MCC codes.

Exact location of a purchase with street, zip, city, region, county, country and GPS coordinates.

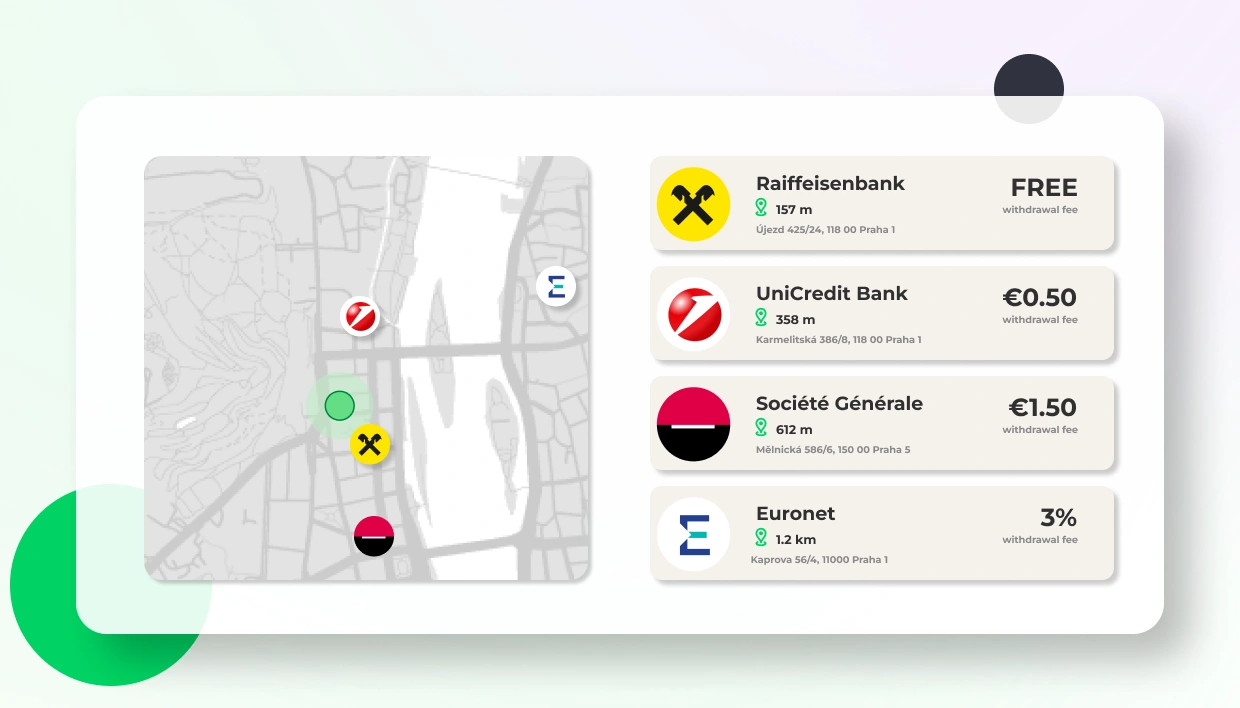

ATM locator with brand name, logo, distance and even withdrawal fee.

Carbon footprint calculation, Eco Labelling and Eco Tips to educate and appraise your clients' habits. Or fulfil your business partners' Scope 1,2,3 reporting requirements.

Label subscription and recurring payments with a special tag to add more clarity.

Guard for fraudulent payments.

TapiX collects, consolidates and enriches data from all relevant payment sources to provide a comprehensive view of customer spending habits

.svg)

TapiX will not provide results unless they are 99,9% accurate. Even an average of 1 complaint per 6,000,000 transactions is not good enough for us.

TapiX engine learns fast and adapts to new regions very quickly. We keep coverage as high as 95% for categorization and 85% for brand recognition.

Tapix enriches data down to the store level. This guarantees a multi-level depth of information.

bunq - the Dutch challenger bank was struggling to achieve a high coverage of merchant reconciliation. Learn more about how TapiX helped them through payment data enrichment.

Ali Niknam

Founder & CEO at bunq

Guides, tips, success stories, industry insights and more

.webp)

Through the TapiX API you only transfer the terminal identifiers. TapiX fulfills the highest security standards and processes no personal information about your clients.