How bunq provides

data-driven insights?

bunq - the Dutch challenger bank was struggling to achieve a high coverage of merchant reconciliation. Learn more about how TapiX helped bunq team reach their goals.

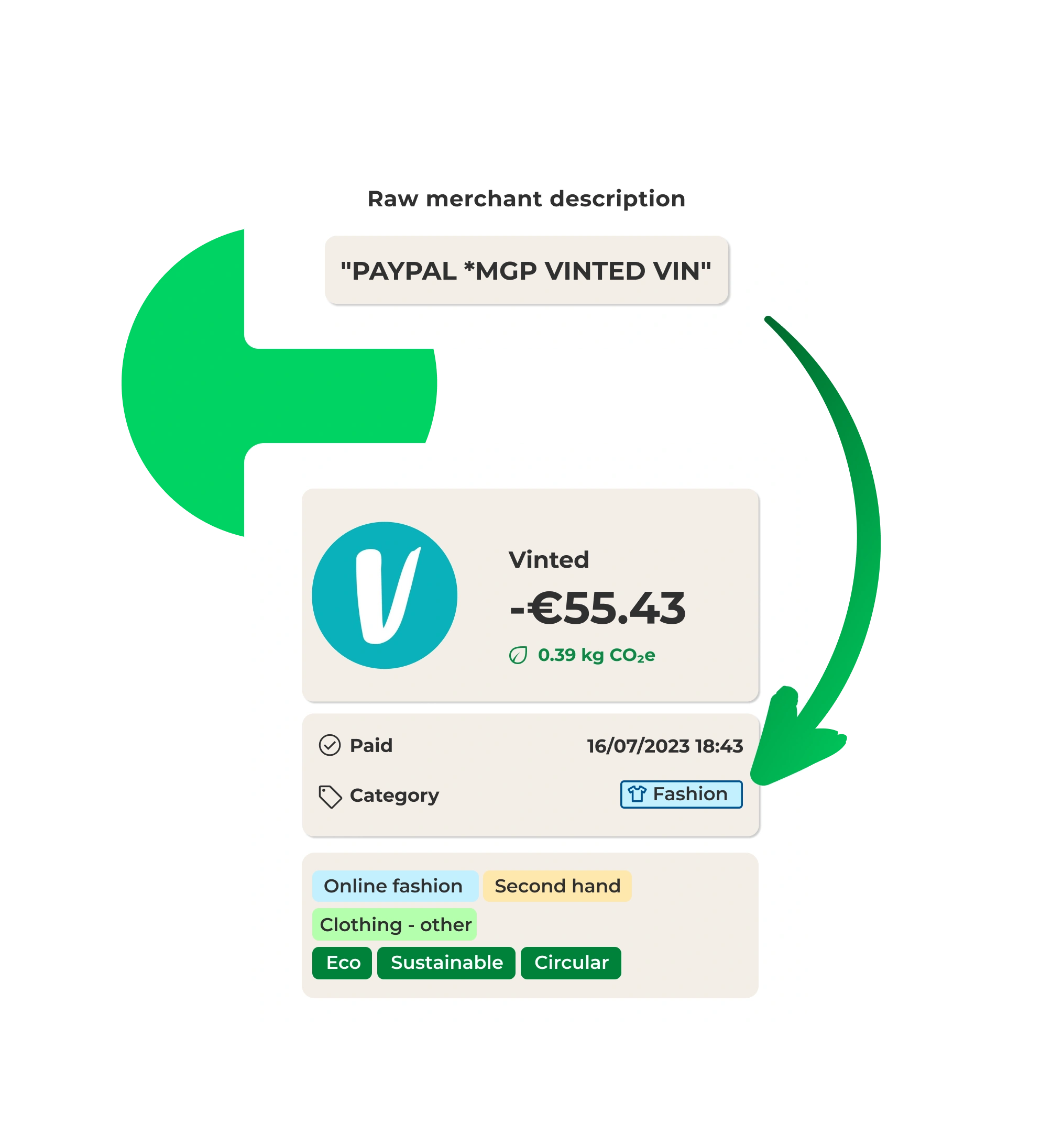

Transaction enrichment datapoint

Understand your client's needs with transactions enriched by comprehensive categories and tags.

Gain deep insights into specific client lifestyle and predict behaviour with a Four-level transaction categorisation system.

Make payment analysis truly insightful through segmentation and tagging for each payment.

Provide SME and Enterprise clients with quality data for financial planning through detailed insights on common business expenses, employee payments or financial transaction recognition.

Improve your client's payment experience by clarifying their personal finance overview through enriched transaction data.

Distinguish recurring payments and subsriptions from daily transactions

Quality transaction data gives you a very detailed insight into cardholder behaviour and habits. Leverage this data for marketing, sales, credit risk or analytical use cases.

Use categorisation to segment and label clients for personalized communication and marketing activities tailored to the customer's lifestyle and interests.

Improve your risk scoring methods by using statistical models and predictors to accurately represent your client’s financial health based on correct transaction categorisation.

bunq - the Dutch challenger bank was struggling to achieve a high coverage of merchant reconciliation. Learn more about how TapiX helped bunq team reach their goals.

Count on the additional services and features that the TapiX team has prepared for you, developed for quality assurance, the ability to evaluate decisions and continuous development.

Offer users the ability to dispute or correct erroneous information within transaction details. Allowing users to claim wrong merchant names, logos, locations, etc., ensure accurate transaction records.

Our Customer Success Managers are ready to guide you through data validation, API implementation, testing and support you through live deployment.

We track data changes and through APIs, clients can easily see which data needs to be refreshed and modified. The client retrieves the updated data through the API and replaces or removes the old data.

We provide an online reporting tool based on MS Power BI to ensure continuous transparency of the product performance for each client.

As a core product, Dateio offers a card-linked marketing platform for targeted offers (cashback and rewards campaigns) supercharged by TapiX enriched payment data.

We hold regular quarterly pulse checks. Ensuring our clients are satisfied and up-to date with our latest product enhancements.