Every financial transaction gives us insight into a user's consumer behavior. Whether it's when a user pays their rent, what regular payments they have set up from Netflix and Spotify to Google Cloud, or how they spend on entertainment or groceries.

Financial data enrichment is essential for fintech companies and banks because it transforms raw transaction data into actionable insights that drive personalised customer experiences, informed decision-making, and operational efficiency. But what is data enrichment in banking? And how do banks monetise data? There are many ways, but most of them lead through data enrichment.

Open banking data

Today's era favours online payments and cash is increasingly taking a back seat, making personal finance management apps even more important. This in turn requires PFM to be even more user-friendly. The complex and often tedious manual process of writing receipts and entering your own expenses, which has often been a stumbling block for these apps, is no longer necessary. This data already exists or can be pulled directly from the bank account history, removing a time-consuming task for consumers.

Banking data, in its unprocessed form, can be difficult to interpret. It might only contain cryptic merchant names or vague descriptions of purchases, leaving gaps in a bank’s ability to understand the customer’s full financial profile. This is where banking data enrichment comes in. It typically involves adding layers of additional information to each transaction, such as standardised merchant names, geographical location, or even categorising purchases into broader spending categories like “groceries,” “entertainment,” or “utilities.” These details allow fintech companies and banks to make financial data far more valuable and actionable.

Thanks to open banking and modern financial APIs, fintech companies can easily and securely analyse their customers' data with just a few clicks. PSD2 makes all this possible. The Second Payment Services Directive, also known as PSD2, is a regulation for electronic payment services in Europe. Its main aim is to increase payment security in Europe, boost innovation in the payments sector and help banking services to use new technologies. PSD2 has 2 main parts: Payment Initiation Services (PIS) and Account Information Services (AIS). The AIS part is important for data enrichment.

Account Information Services (AIS):

- Account balance

- Transaction history and details of individual transactions

- Account type (current, savings, etc.)

- Account currency

- Account holder details

AIS data collected with user permission helps financial innovators like HyperJar or Plum to easily and securely access and interpret end-user data.

But working with this data is not an easy task. According to Deloitte, selecting a specific data set and processing it is one of the biggest challenges facing financial institutions and fintechs. They have to work with a vast amount of data that they process every day.

Insights into finance through open banking

Daily transactions provide insights into consumer behavior, such as when a user pays rent. Here we can look from a risk perspective, for example whether the user has a standing order and pays regularly or always puts money together at the last minute. We can also look at regular financial commitments and the most common spending behavior.

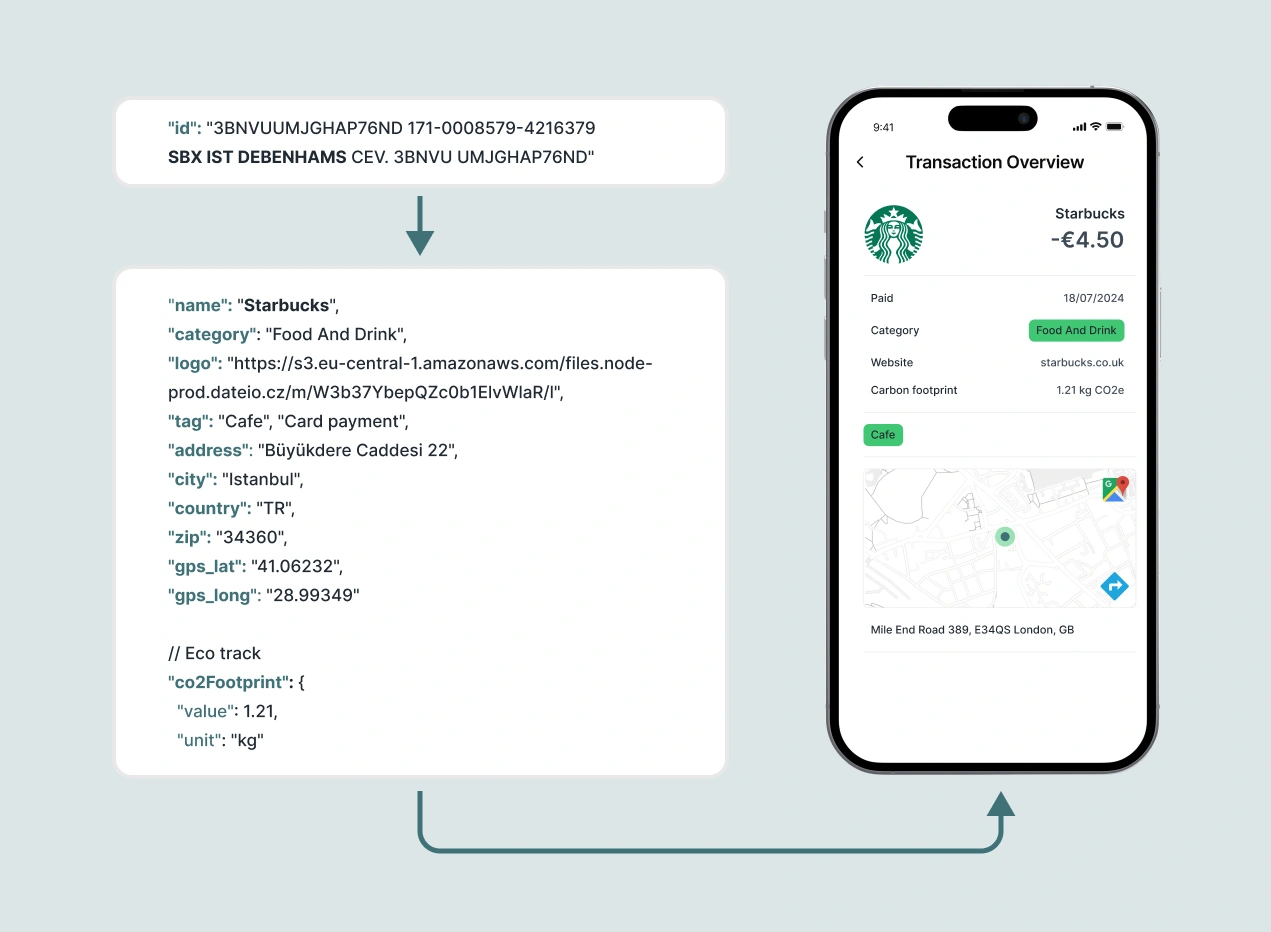

But firstly, let's dive into the flow of enrichment. The process of enrichment of open banking data looks as follows:

In the example transaction, we derive the merchant description from the input data. Once the merchant description is found, Tapix matches the merchant description with the database and finds the correct result.

To shed light on the comparison of the open data with traditional payment data. Open data typically contains only 2 input data points and practically never more than 4. The full data provides 9 useful data points (3 times as much useful data for detecting terminal). This plays a pivotal role and increases the chance of enrichment or, in an open data world, decreases the chances without prior expertise.

Discover how to enhance your financial data – book your free intro call today!

Now that we are aware of the process, we can dive deeper into more specific use cases. Thanks to the financial data enrichment, you can visualise this data and gain valuable insights into where customers are spending most often. In the same way, we can look at data on ATM withdrawals and, for example, decide how to place them more effectively.

Payment data enrichment can significantly impact a variety of businesses, from accounting platforms to traditional financial institutions. Tapix's data categorisation model transforms raw transactional data into structured and standardised information that helps not only financial institutions gain data-driven insights, but also provides clarity for the end user.

The use of these tools, including Tapix, for transaction categorisation, can free fintech companies, personal finance management apps, and traditional banks from manually interpreting and classifying the information contained in the transaction labels themselves, which requires a notable amount of in-house resources.

Banks use enriched data not only to provide better insights for customers but also to streamline internal operations and enhance overall efficiency. By enhancing transaction data, banks can automate various processes that traditionally require manual intervention, saving time, reducing operational costs, and improving accuracy.

One key area where data enrichment helps banks is in the automation of transaction categorisation. Instead of relying on manual classification or raw transaction descriptions, which can be inconsistent or unclear, banks can use enriched data to automatically categorise transactions based on standardised merchant names and spending categories. This allows them to provide their customers with clear and organised account statements, offering better visibility into their spending habits.

The final result may look as follows:

Open banking - from PSD2 to PSD3

Open banking is made possible by PSD2, a directive that created a legislative framework that allows third parties to access customers' bank accounts (with their consent), which is the cornerstone of the open banking concept. This has enabled new financial products and services to emerge that leverage the data and functionality of traditional banks, increasing competition and innovation in the banking sector.

The European Commission (EC), on 28 June 2023, published its proposal to revise the European Union's payment services legislation, as well as a proposal on open finance and data access in the financial services sector beyond open banking/payment accounts in the form of a new Open Finance proposal called "FIDA". This is now the start of the EU legislative process in relation to these texts. However, it is not clear how long the legislative process will take. We will keep an eye on the changes this directive will bring for you and will bring you detailed information soon.