Deliver the best UX

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Tapix enables banks, fintechs and card issuers to comply with Visa’s Enhanced Merchant Data requirement and Mastercard’s AN4569 Revised Standards while transforming compliance into a digital experience customers love and trust.

Enhanced Data Rules are more than compliance. It’s a chance to redefine digital banking clarity.

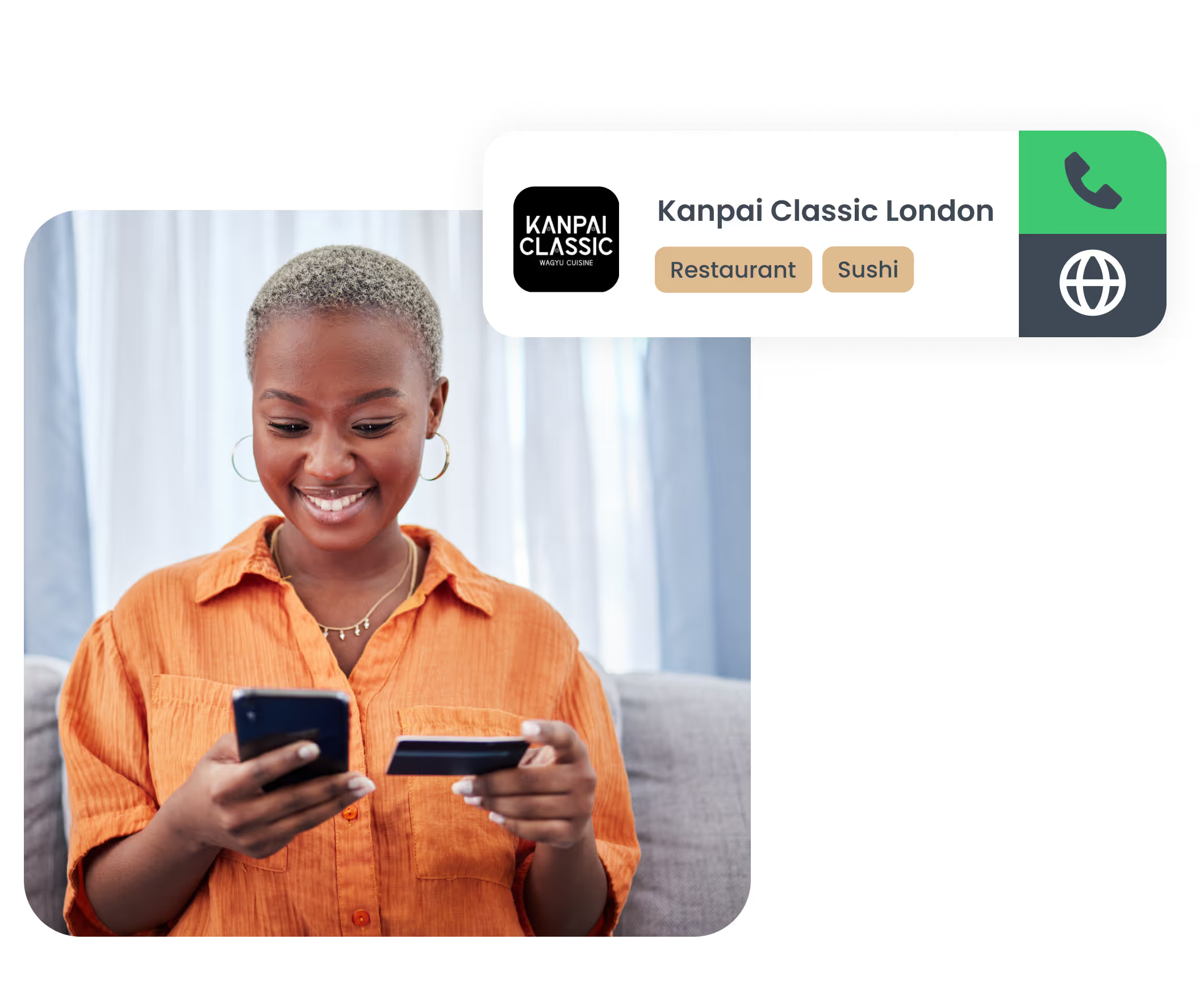

Tapix helps elevate the post-purchase experience to the same level of excellence customers expect from global digital innovators such as Revolut or Monzo.

Meet all requirements of Visa’s and Mastercards’s Enhanced Merchant Data rules on time and with confidence.

Reduce chargebacks and support calls by ensuring customers recognise every purchase instantly and intuitively.

Deliver post-purchase journeys that match leading fintech-level UX and remind customers why they love banking with you.

Clarity builds emotional connection. Every clear transaction is a small moment of trust that compounds over time.

Trusted by 50+ global banks and fintechs

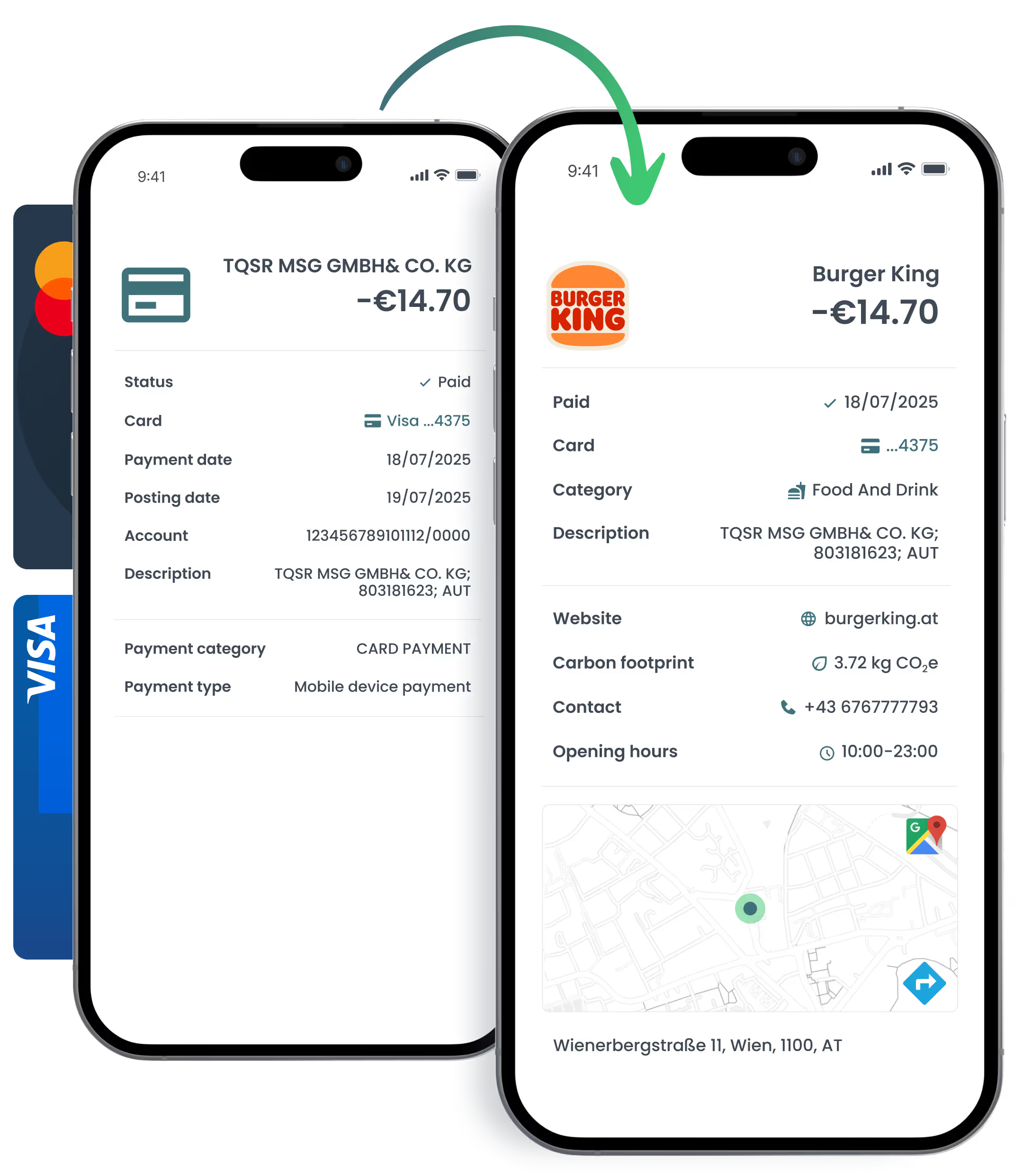

Replace confusing and unstructured merchant descriptors with clean, localised names that customers instantly recognise.

Access a database of over 69k brand logos, each following strict brand guidelines, to ensure customers recognise merchants with ease.

Show where each transaction happened, not just what it cost.

Enable seamless re-orders and issue resolution with verified contact details and links

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Provide the best possible experience to clients when searching for a place to withdraw money

Fuel digital transactions with accurate merchant insights

Recognise recurring payments, subscriptions, or direct debits for control and predictability.

Meet all the requirements of AN 4569 Revised Standard

Explore how Tapix can help you get the most from transaction data, increase your app engagement and turn UX into your competitive advantage.