User Experience

Use Cases

Increase your app engagement and turn UX into your competitive advantage.

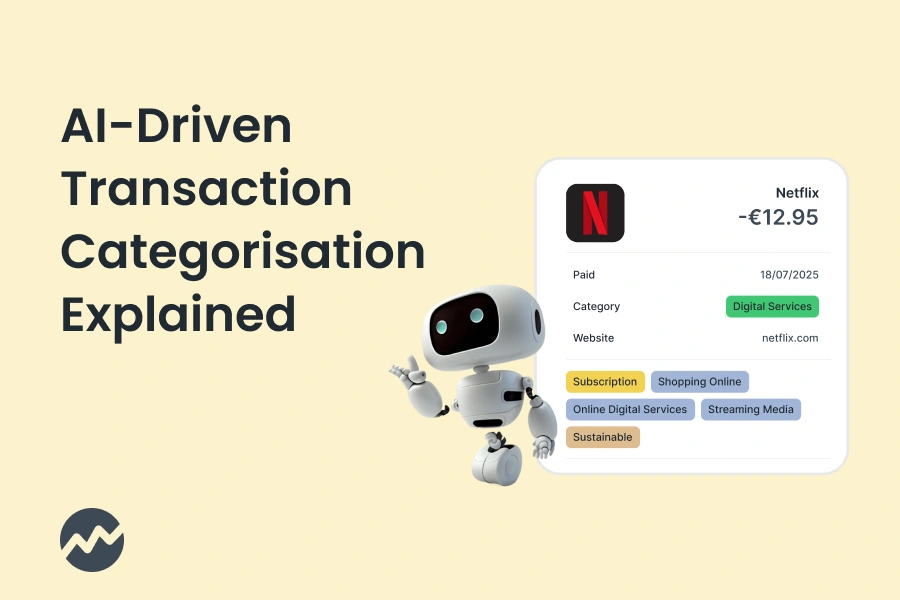

Tapix enriches payment data with merchant, category, and behavioral context by turning every transaction into insight for smarter analytics, personalised banking, and compliant digital experiences.

Trusted by 50+ global banks and fintechs

Your client makes a payment or transaction

Raw data are stored within your infrastructure

Data are turned into meaningful information

Use data for your analytics, UX, ESG or business cases.

We believe the better data you have, the less work you have to do. Put full focus on solution building, rather than messy data wrangling.

Increase your app engagement and turn UX into your competitive advantage.

.webp)

Leverage smart data for your internal teams and truly understand your clients' lives.

Leverage the carbon footprint calculation for each transaction to exceed the Responsible Banking Commitment.

Tapix will not provide results unless they are 99.99% accurate. Even an average of 1 complaint per 6,000,000 transactions is not good enough for us.

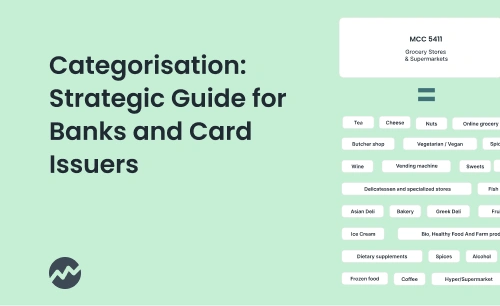

Tapix engine learns fast and adapts to new regions very quickly. We keep coverage as high as 95% for categorisation and 85% for brand recognition.

Tapix enriches data down to the store level. This guarantees a multi-level depth of information.

Through the Tapix API you only transfer the terminal identifiers. Tapix fulfills the highest security standards and processes no personal information about your clients.

ISO 27001 certified

GDPR compliant

OAUTH 2

AWS for data stores and processes