Don’t feel like reading? Listen to the audio version.

Introduction

Key Performance Indicators (KPIs) serve as crucial tools, allowing banks to measure how effective their digital banking apps are in engaging customers. In this guide, we'll explore seven essential customer success KPIs, complete with straightforward formulas, designed to help banks improve customer engagement, foster loyalty, and reduce churn rates. These digital banking KPI examples provide valuable insights into customer behavior and operational efficiency, making them indispensable for any banking KPI dashboard.

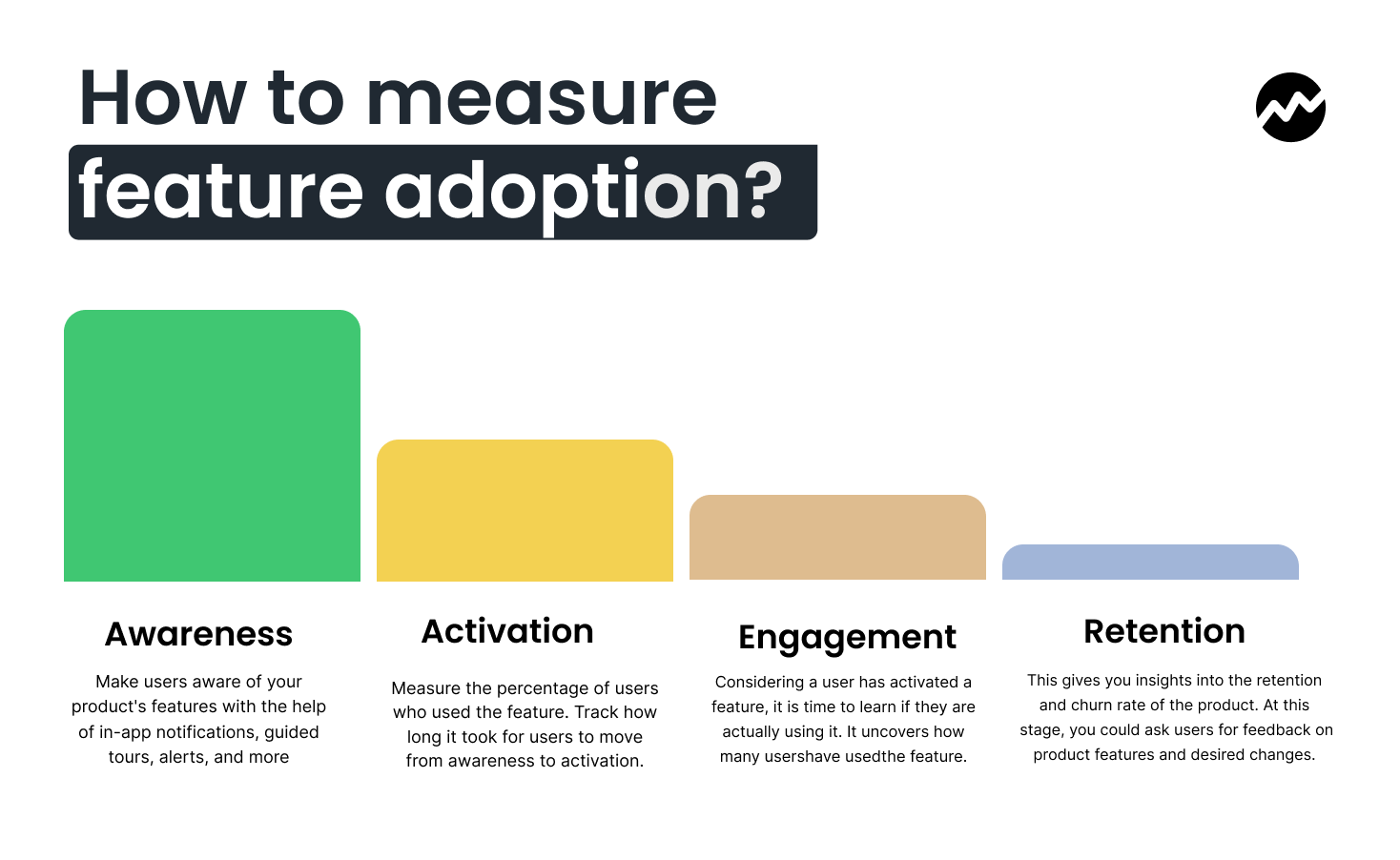

1. Feature Adoption Depth

Formula: (Number of features used by a customer per month / Total number of features available) * 100

Feature Adoption Depth measures the extent to which customers engage with the various features of a digital banking app. This KPI is vital for understanding which features resonate most with users and identifying potential areas for improvement. A higher adoption rate suggests that the app is delivering value through its features, while a low adoption rate may indicate that users are not finding the app’s tools intuitive or necessary.

For example, if a user utilises 8 out of 12 available features, the Feature Adoption Depth would be (8 / 12) * 100 = 66.67%. By tracking this metric, banks can prioritise feature development based on customer preferences and enhance user experiences.

Did you know? Feature adoption can vary widely depending on user demographics and the types of features offered. For example, younger users may be more likely to adopt mobile payments or peer-to-peer transfer features, while older users might prioritise check deposit or budgeting tools.

2. Average Time to First Transaction

Formula: (Total time taken by all users to complete their first transaction / Number of users)

This KPI measures how quickly users complete their first transaction after downloading and onboarding to the app. A shorter Average Time to First Transaction (ATFT) is a sign of efficient onboarding, suggesting that the app's user interface and navigation are intuitive and seamless. A long ATFT, on the other hand, could indicate friction points in the user journey or a complicated onboarding process.

For instance, if three users take 2, 5, and 3 minutes to complete their first transaction, the Average Time to First Transaction would be (2 + 5 + 3) / 3 = 3.33 minutes. A lower average time suggests that customers can quickly grasp how to use the app for their primary task - completing a transaction.

3. Turnaround Time (TAT)

Formula: (Total time taken to complete a specific business process / Number of processes completed)

Turnaround Time (TAT) measures the efficiency of critical business processes within digital banking. This includes everything from payments to loan approvals. The faster these processes are completed, the more efficient the bank's operations become, leading to higher customer satisfaction and retention.

For example, if a bank takes 100 minutes to complete 10 payment transactions, the TAT would be 100 / 10 = 10 minutes per transaction. Shorter turnaround times signify better operational efficiency and a streamlined user experience.

4. Monthly Active Users (MAUs)

Formula: (Number of unique users who open the app at least once in a 30-day period / Total number of users) * 100

Monthly Active Users (MAUs) provide a clear picture of user engagement over a 30-day period. This metric is crucial for banks to track whether their digital banking app continues to provide value to users over time. If a significant percentage of registered users do not return to the app regularly, it may suggest that the app isn’t meeting their needs or that they’re turning to competitors.

For instance, if a bank has 5,000 unique users and 3,500 open the app at least once in a month, the MAU would be (3,500 / 5,000) * 100 = 70%. MAUs are a leading indicator of customer loyalty and app relevance.

Did you know? Banks should aim to increase their MAUs by consistently improving the app’s usability, adding value through new features, and promoting app usage with targeted campaigns.

5. Abandonment Rate

Formula: ((Number of users who abandon a process / Total number of users who start the process) * 100)

Abandon Rate provides insights into customer behavior during transactions or processes within the app. A high abandonment rate indicates friction in the user journey - whether it’s related to app performance, complexity, or a lack of trust. For example, if 100 users start a transaction process but only 80 complete it, the abandonment rate would be (20 / 100) * 100 = 20%.

Did you know? To reduce abandonment rates, banks should conduct usability testing and continuously gather user feedback. Identifying and fixing common pain points will improve the completion rates and enhance the overall user experience.

6. Net Promoter Score (NPS)

Formula: (Percentage of Promoters - Percentage of Detractors)

The Net Promoter Score (NPS) measures customer satisfaction and loyalty by asking users whether they would recommend the app to others. NPS is a highly effective way to assess overall sentiment and predict future growth. If 60% of users are Promoters (satisfied customers who would recommend the app), and 20% are Detractors (dissatisfied users), the NPS would be 60 - 20 = 40.

A positive NPS is an indicator of strong customer loyalty and satisfaction, which are critical for long-term success in the competitive digital banking market.

7. Retention Rate

Formula: ((Number of unique returning users / Total unique users in a specific period) * 100)

Retention Rate is one of the most important KPIs for measuring customer loyalty. It tracks how many users return to the app after their first experience. A higher retention rate indicates that users find ongoing value in the app, and it suggests that the app successfully meets their needs over time.

For example, if a bank has 2,500 unique users and 2,000 of them return within a specific period, the Retention Rate would be (2,000 / 2,500) * 100 = 80%.

These seven key performance indicators (KPIs) offer a robust framework for assessing app performance. Consistently tracking and responding to these metrics empowers banks to enhance user experiences, cultivate enduring customer relationships, and thrive in today's digitally savvy environment.